Navigating Energy Efficiency Tax Credits and Incentives

A Comprehensive Guide for Building Owners, Developers, and Designers

Summary:

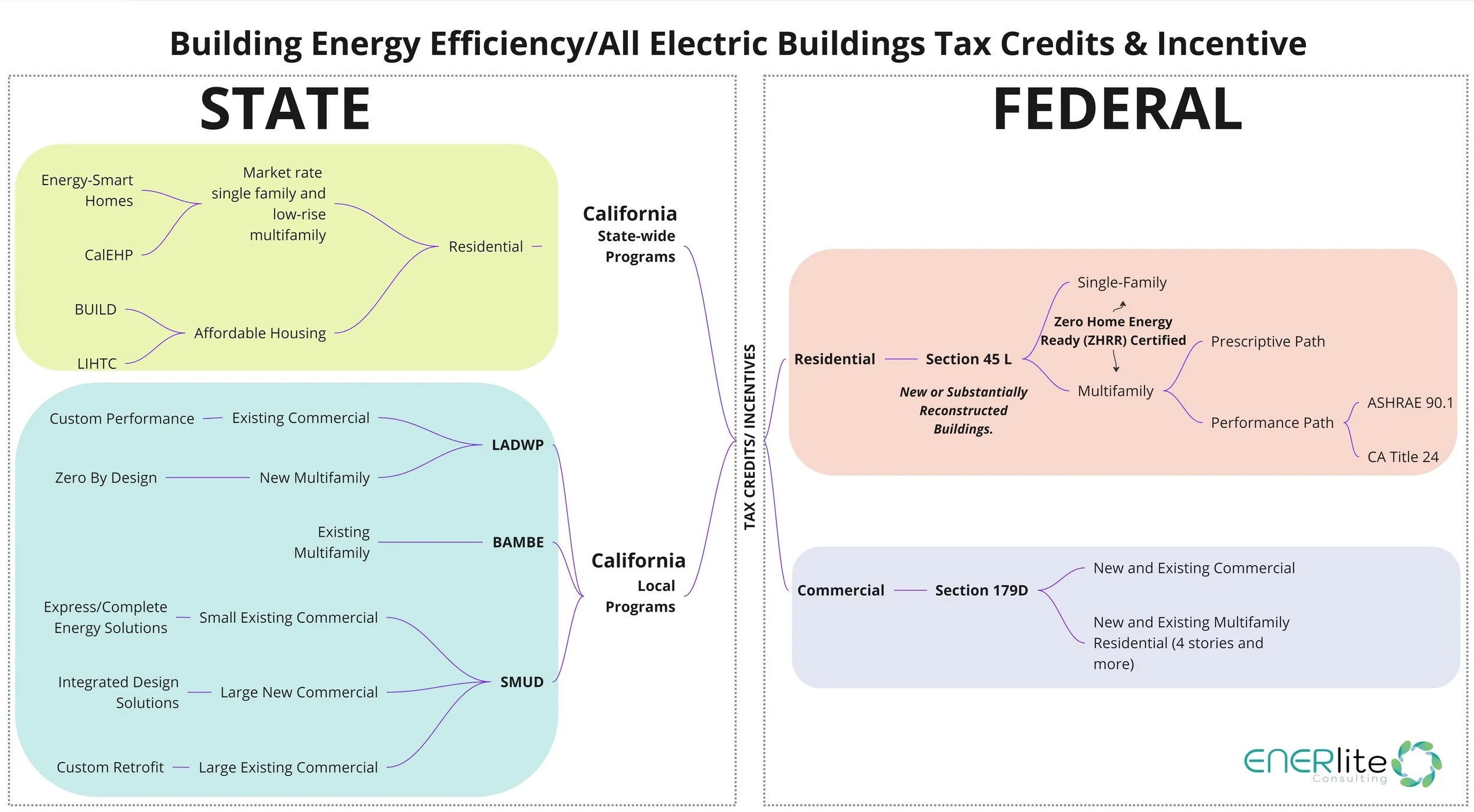

In today's era of sustainable development and environmental consciousness, understanding the myriad tax credits and incentives available for energy-efficient buildings is crucial. This comprehensive blog post serves as a detailed roadmap, providing a concise yet comprehensive overview of federal, state, and local programs. A user-friendly tree diagram map is presented to simplify the complex landscape of incentives, making it easily digestible for building owners, developers, and designers. The post outlines various tax credits and incentives, facilitating informed decision-making for those aiming to incorporate energy-efficient practices into their projects. Additionally, the blog offers deeper insights into select programs, ensuring a comprehensive understanding of the available options.

Federal Tax Credits:

The 2022 Inflation Reduction Act (IRA) Section 45L has issued tax credits for new or substantially reconstructed single-family and multifamily buildings. This credit includes $1,000 to $5,000 per-unit tax credits for eligible contractors of buildings that follow the ENERGY STAR or Department of Energy (DOE) Zero Energy Ready Home (ZERH) guidelines.

The IRA also changed Section 179D of the IRC to award tax credits for qualified commercial and multifamily residential (4 stories and more) building owners and designers of those buildings. This incentive includes both new construction and existing buildings’ retrofits with 25% or more energy efficiency compared to a specified Reference Standard.

State Tax Credits:

State-wide Programs in California

The state of California offers the most wide-ranging set of powerful incentives for energy efficiency in the U.S. The California Tax Credit Allocation Committee (CTCAC) oversees the Low-Income Housing Tax Credit (LIHTC) Program. This program provides developers with incentives if their dwelling units demonstrate lower utility costs due to energy efficiency. The program promotes the development of affordable rental housing for low-income California residents; it uses the California Utility Allowance Calculator (CUAC) to predict utility estimates for new residential buildings. In 2023, CUAC integrated into CBECC 2022, the California Energy Commission’s (CEC) software for performance modeling path through Title 24 code compliance. This has simplified the incentive application process.

The CEC offers the Building Initiative for Low Emission Development (BUILD) Incentives for all-electric new and substantially reconstructed residential buildings. Commercial buildings repurposed for residential housing are also eligible for this program. The projects must meet the low income residential housing income limit requirements for this program. BUILD incentives are rewarded through a project’s anticipated modeled greenhouse gas (GHG) emission reduction compared to the mixed-fuel 2019 Energy Code standards.

The California Energy Smart Homes program is for market-rate single-family and low-rise residential buildings (3 floors and below) for both new construction and alteration projects. Being an all-electric building is the main requirement to be eligible for this program. The building should be located in the Pacific Gas and Electric Company (PG&E®), San Diego Gas & Electric Company (SDG&E®), and Southern California Edison Company (SCE®) electric territories.

The California Electric Home Program (CalEHP) is for market-rate new residential projects, including single-family, low-rise, and high-rise multifamily buildings throughout the state of California. Projects located in disadvantaged communities and hard-to-reach areas receive higher incentives. In addition, higher performance according to Title 24 prescriptive rates has bonus incentives.

Local Programs in California

In Los Angeles, energy efficiency incentives are offered by the LA Department of Water and Power (LADWP). The Custom Performance Program is defined for existing commercial buildings and the Zero By Design Program is for new multifamily residential projects in the LADWP service area. These programs provide substantial discounts for efficient lighting and HVAC systems that can be achieved through energy modeling and retrofitting.

In the Bay Area, BAMBE helps existing multifamily properties plan improvements designed to save 10% or more of a building’s energy and water usage. BAMBE supports multifamily property owners to improve apartments' energy efficiency and indoor air quality and eliminate greenhouse gasses to reduce owner and tenant bills. BAMBE recently introduced the new Clean Heating Pathway to provide rebates from $250 - $15,000 to multifamily property owners that switch from gas-fueled equipment to electric.

Sacramento Municipal Utility District (SMUD) provides similar incentives in Sacramento, offering rebates for commercial buildings including Express Energy Solutions for a single upgrade in one commercial building and Complete Energy Solutions for more comprehensive energy upgrades. For large existing commercial buildings, the Custom Retrofit program includes electrification and retro-commissioning. For large new commercial buildings or substantial renovation of existing large commercial buildings, the Integrated Design Solutions program is offered. The Performance Approach of the Integrated Design Solutions program for new buildings requires the calculation of energy savings using the Title 24 energy models. For those who are not located in Los Angeles, the Bay Area, or Sacramento, we recommend researching your local utility program to determine what incentives are available to you.

ENERlite Consulting Inc. offers consultation and energy modeling services aimed at estimating applicable tax incentives. For further details and to schedule a call to discuss your project, please reach out to lghobad@enerlite-consulting.com.

Please note that this blog does not encompass all available credits. We encourage further exploration and consultation for a comprehensive understanding of offered incentives.